tax rate malaysia 2018

Corporate tax rates for companies resident in Malaysia is 24. On the First 10000 Next 10000.

Malaysia Personal Income Tax Rate 2022 Data 2023 Forecast 2004 2021 Historical

Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in Malaysia.

. 2 This Order comes into operation on 1 September 2018. 1 The rate of sales tax to be charged and levied shall be fixed at ten per cent on all goods except a goods. For little and medium venture SME the main RM500000 Chargeable Income will be impose at 18 and the Chargeable Income above RM500000 will be assess at 24 subject to.

20172018 Malaysian Tax Booklet. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum. In the calendar year 2018 the tax rate for medium sized business in Malaysia was 196 percent of commercial profits.

Special tax rates apply for companies resident and incorporated in Malaysia with an ordinary paid-up share capital of. Rate of sales tax 2. Goods SST on goods is charged throughout the B2B chain to the final consumer and is not deductible by tax payers.

A non-resident individual is taxed at a flat rate of 30 on total taxable income. The standard corporate tax rate of 24 for a period of five years with a possible extension for another five years. An effective petroleum income tax rate of 25 applies on income from.

A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at. They have several different classifications of property types and different types have different tax rates with low cost flats being the lowest at 2 and luxury serviced residences at. Tax Rate of Company.

Which goods or services. This publication is a quick reference guide outlining Malaysian tax information which is based on taxation laws and current practice. On the First 2500.

Income tax rate Malaysia 2018 vs 2017 For assessment year 2018 the IRB has made some significant changes in the tax rates for the lower income groups. Malaysia Income Tax Rate for Individual Tax Payers Lowest Individual Tax Rate is 2 and Highest Rate is 26 for 2014 and Lowest Tax Rate for Year 2015 is 1 and Highest Rate is 25 Non. Malaysia was ranked 12 out of 190 countries for ease of.

Sales Tax and Service Tax were implemented in Malaysia on 1 September 2018 replacing Goods and Services Tax GST. Rate TaxRM 0-2500. Malaysia Personal Income Tax Rate.

Expatriates that are seen as residents for tax purposes will pay. For existing companiesincluding existing companies with approved. On the First 5000 Next 5000.

Not only are the. 10 percent for Sales Tax and 6. Expatriates that have been working in Malaysia for longer than 182 days in a year are considered tax resident.

Malaysia Sales Tax Rate 2022 Take Profit Org

Service Tax Exemption On Eligible Labuan Incorporated Entities

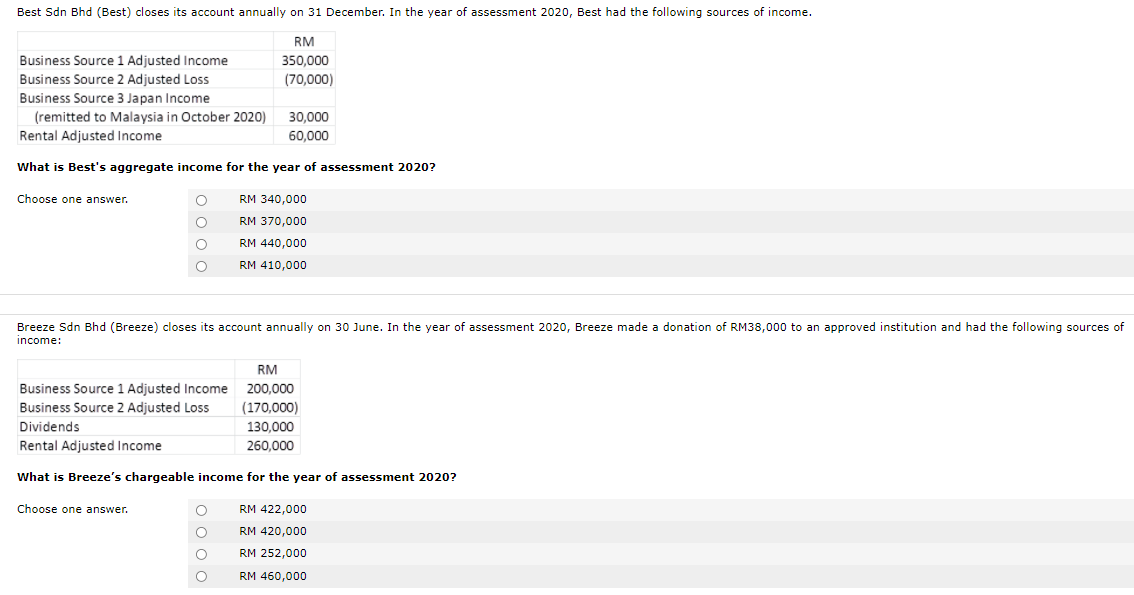

Tax 467 March 2019 Question 1 Mr Noah An American Citizen Was Employed As A Dentist By My Dental Studocu

List Of Countries By Tax Rates Wikipedia

Malaysia Sales And Services Tax Sst 2022 Data 2023 Forecast

Income Tax Malaysia 2018 Mypf My

Snapshot Of Asean Tax Rates Htj Tax

Cover Story Budget 2020 Top Tax Bracket Raised To 30 Tin Number Proposed The Edge Markets

Comparing Tax Rates Across Asean Asean Business News

How Important Is Tax Competition To India International Tax Review

Rate 0 1 3 8 Individual Income Tax Rates Ya 2018 To Chegg Com

Snapshot Of Asean Tax Rates Htj Tax

2018 2019 Malaysian Tax Booklet

Malaysia Special Voluntary Disclosure Programme Commonwealth Association Of Tax Administrators

Tax Rates For Year Of Assessment 2018 T Plctaxconsultants

Comments

Post a Comment